Alongside a detailed trading plan, most successful traders keep a log of their trades in a trading journal. The journal can be used to track each trade individually or to track the trading day as a whole. The best traders use this journal to review and reflect on their process and how well they entered, managed, and exited their trades. It allows them to track hard data such as risk to reward ratios, strike rate, and entry type, as well as soft data such as performance analysis and personal progress.

In this article we are going to cover the three sections that should be included in any great trading journal: the (1) hard data, the (2) explanation of trades, and the (3) post-trade review.

Section 1: Hard Data

The first section of your trading journal should cover the Hard Data.

What is Hard Data?

These are the factors that cannot be changed, such as the news for that day, the date and time of your trades, and your grading of the entry setup.

The more relevant data you track, the easier it is to see and refine your edge. Relevant data will be custom to you and what you decide is important in your trading.

For example, I keep track of my stop loss in pips, but I do not track the entry or exit price because the numbers aren’t meaningful to me – I trade patterns and structure, not the prices themselves.

Let’s go over some data you may consider tracking.

Entry Type

If you have multiple entry strategies, tracking your entry type will allow you to see which setups you trade the best and most often, and will help you identify your best performing setups in the current market conditions.

If you notice that an entry is under-performing in comparison to the rest of your entries, cutting it out or decreasing the risk allotted to that setup may increase your overall P&L.

In my earlier days of trading with ASFX I decided to cut out the D2 entry signal, which is an advanced reversal trade that is a part of our system. My strike rate and risk-to-reward ratio on the setup wasn’t as high as the other setups I traded and the stress I had to endure to see the trade fully through made the entry signal not worth trading for me.

Setup Grade

Differentiating between your valid and most probable trades will help you concentrate your efforts on the setups that reward you the most. This is also a good way to keep track of your discipline and your trading mindset.

Trading more valid setups over high probability setups could show a lack of discipline and should be addressed. If you are trading a lot of what your system calls “high probability setups” and losing,, then this would raise a red flag and you would be aware of a shift that has occurred within the system in question or within the market.

Taking a lot of lower quality setups instead of your high probability setups, could also indicate a shift in your trading mindset. Here are some questions you can ask yourself to check in on your mindset:

- Am I forcing trades instead of waiting for my best setups to come to me?

- Am I getting into trades early or late because of FOMO (fear of missing out)?

- Am I “fudging it” on my setups and taking entries that don’t have all of the confirmations I normally need to take a trade?

It is unlikely you would be aware of these shifts if you were not tracking and reviewing your setup grade.

Watchlist for the Day

Tracking your watchlist will allow you to see if you are getting yourself involved with the best pairs for that day. The best pairs are the one that have the highest likelihood of generating a high probability trade idea for you to take.

At the end of the week you can look at your watchlist for each journal entry and objectively see if you were focused on the best pairs that week.

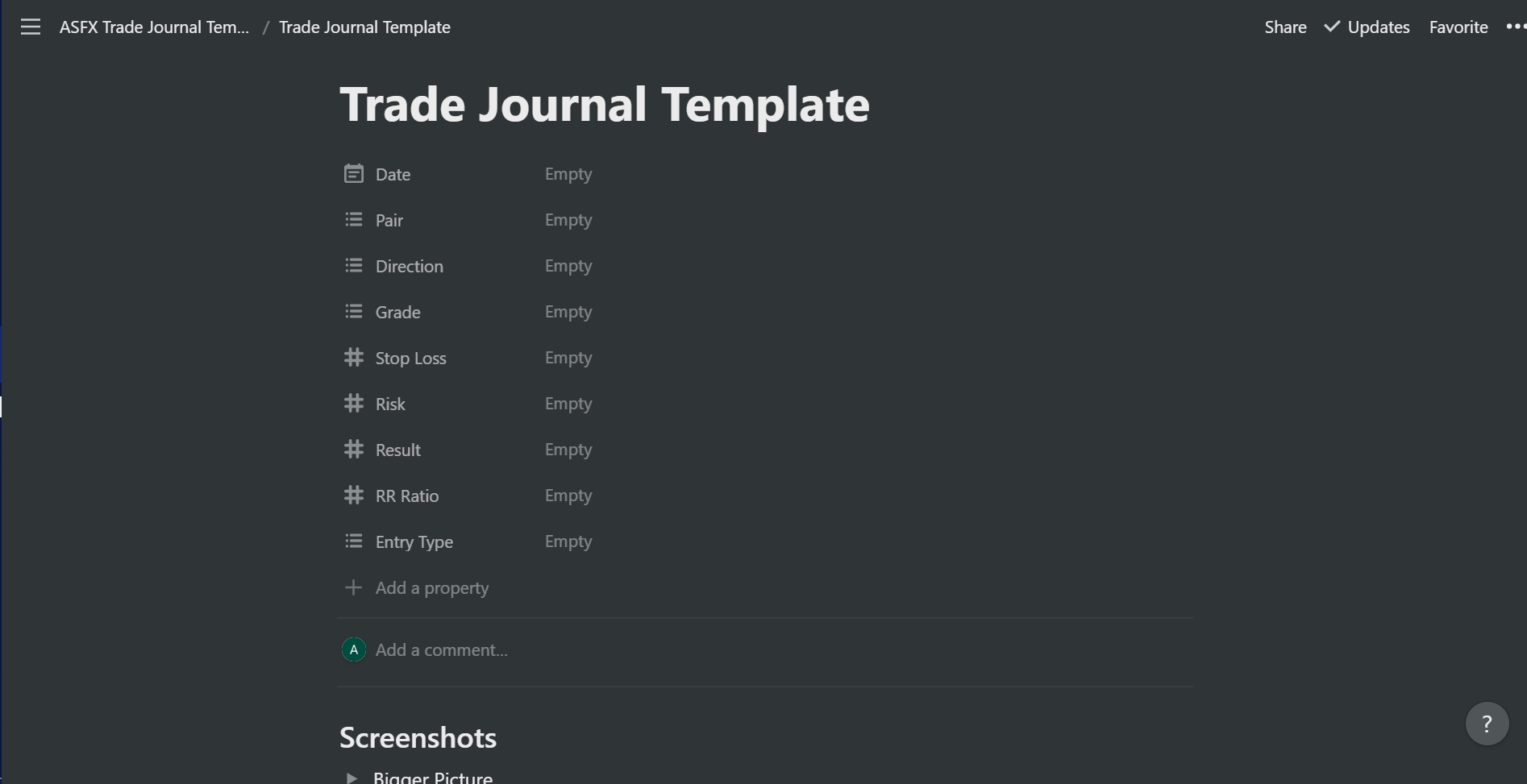

Here is a picture of the hard data section of my trading journal:

Section 2: Explanation of Trades

In this section you should break down why you took the trade, how you managed the trade, and how you exited the trade. If you are using a computer you can also use this section to include screenshots of the trade as it developed, especially if you notice that you often close your trades early based on emotions such as fear or greed.

When you trade from a mindset driven by emotion you are going to filter out some of the signals the market is giving you, whether the market is telling you that you need to cut the trade or that you should still have a piece of your trade running.

It will also allow you to clearly see if you are repeating the same mistakes, such as shorting an uptrend or not waiting for enough confluence before you enter into a position.

I like to include the screenshots of the higher time frames so I can be sure that I am zooming out prior to entering a trade so I can be aware of where I am in the overall context of the market.

A third reason to explain your trades is to demonstrate to yourself that your edge is clearly defined. Do you have concrete reasons for taking the trade and managing it how you did? It will also allow you to take notes of everything you see and possibly pick up on patterns that will lead you to increase your profits or keep you out of losing trades.

Section 3: Post Trade Review

This section is meant to push your trading to new heights and create a space where you can analyze your decisions, actions, and how well you followed your rules.

Here, you need to ask yourself questions about how you felt before, during, and after the trade. You can evaluate your trading performance and consider giving yourself a grade or a rating for how well you traded.

These review questions can be completed after the trade is closed out and/or at the end of the week. I prefer to do my refinement on Saturdays because it allows me to come to the chart objectively and with a fresh perspective. Sometimes we think we are seeing things clearly but we don’t realize we were too zoomed in or focused on the wrong thing until after we are no longer emotionally invested in the trade. Sometimes that takes a few days.

One of my favorite (and the first) questions I ask myself in my journal: Is this trade outlined in detail in my trading playbook?plan?

It’s an easy way to always keep my actions in line with my trading plan. I wouldn’t want to start my trade review showcasing a lack of discipline and disrespect for the market.

Now you understand the elements that make a great trading journal:

- the hard data that allows you to clearly see your edge

- the explanation of your trade that will ensure you are conscious of your trading decisions

- the post trade review questions that will allow you to analyze your performance and help you refine your edge to take your trading to the next level.

If you use the tips from this article to help you create your own trading journal, be sure to post it and tag us on Instagram with #ASFXTradingJournal so we can share it with everyone!

Get a copy of Gwendoyn’s Notion template

Get a copy of Alex Alfonso’s Notion template

Watch Austin’s video explanation of his daily trading journal below!