When and Why Austin Uses A Stop Loss

Today, we are going to analyze one of Austin’s recent trades: EurUsd. This trade is a perfect example of when and why Austin uses a stop loss. It also shows why stop loss’s are very important and also how to utilize them properly.

This trade has a lot of weight in Austin’s book just because it was one of those trades that could have continued to go in his direction but he managed it properly so that, when it did turn around to actually end up coming against him, he was able to still end up profitable on this trade.

This trade comes after the last recap here: EurUsd Forex Trade Recap | ASFX. This was a EurUsd position that stopped Austin out and then continued to move in the direction that he was trading. Seeing this, a lot of people commented on that video and said “Austin, how did you not catch the whole move? What do we do to catch the whole move?”

“Austin, how did you not catch the whole move? What do we do to catch the whole move?”

What Austin always says is that “we need to follow our tested rules.”

“We need to follow our tested rules.”

If traders are following those tested rules, some trades are going to pull back and stop you out in profit; you’re going to have to learn how to walk away from that and wait for the next entry.

Some of them will stop you out before they go against you, so in that sense, it’s good to have your stop loss there. There will also be trades that don’t pull back at all, and you will be able to take advantage of the full move.

The only way to sometimes take advantage of the full move is to have consistent rules and follow those rules for all of the trades.

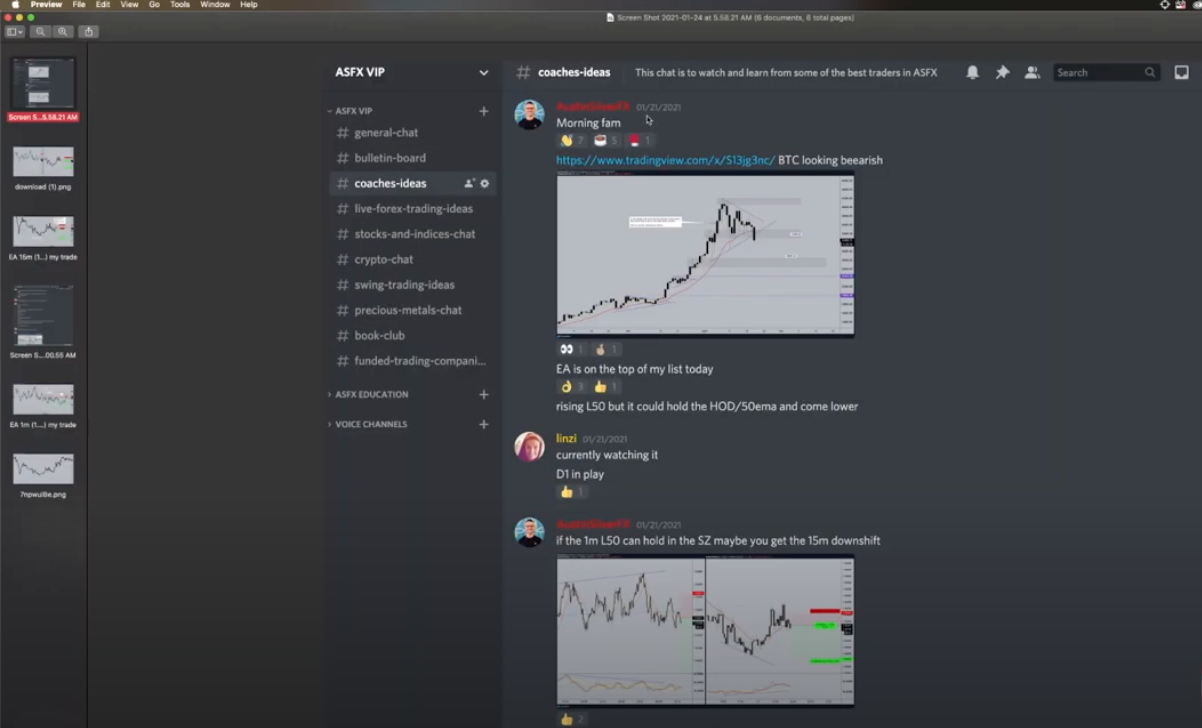

Let’s take a look at what happened in our group chat:

You can see here, that it was Thursday, Jan 21. Austin said good morning, gave a little bit of a Bitcoin analysis, and then Austin sent his chart of EurAud and said, “if the 1 minute, L50 can hold in the SZ (sell zone) maybe you get the 15m downshift.” This is ASFX lingo that the community learns in the course.

So, as you can see looking at the charts, we have the 15-minute chart of EurAud on the right side and the 1-minute chart on the left side. There was bearish divergence present on the 1-minute chart with the price rising and the RSI falling. That set up the potential for us to see this move lower.

What Austin didn’t like about this setup was that, on the 15-minute chart, we had bullish divergence from last night and we were still basically trading within the Asian Range. We had just barely broken out of the Asian Range, but it was very much sideways. Having said this, Austin was trying to follow the overall downtrend.

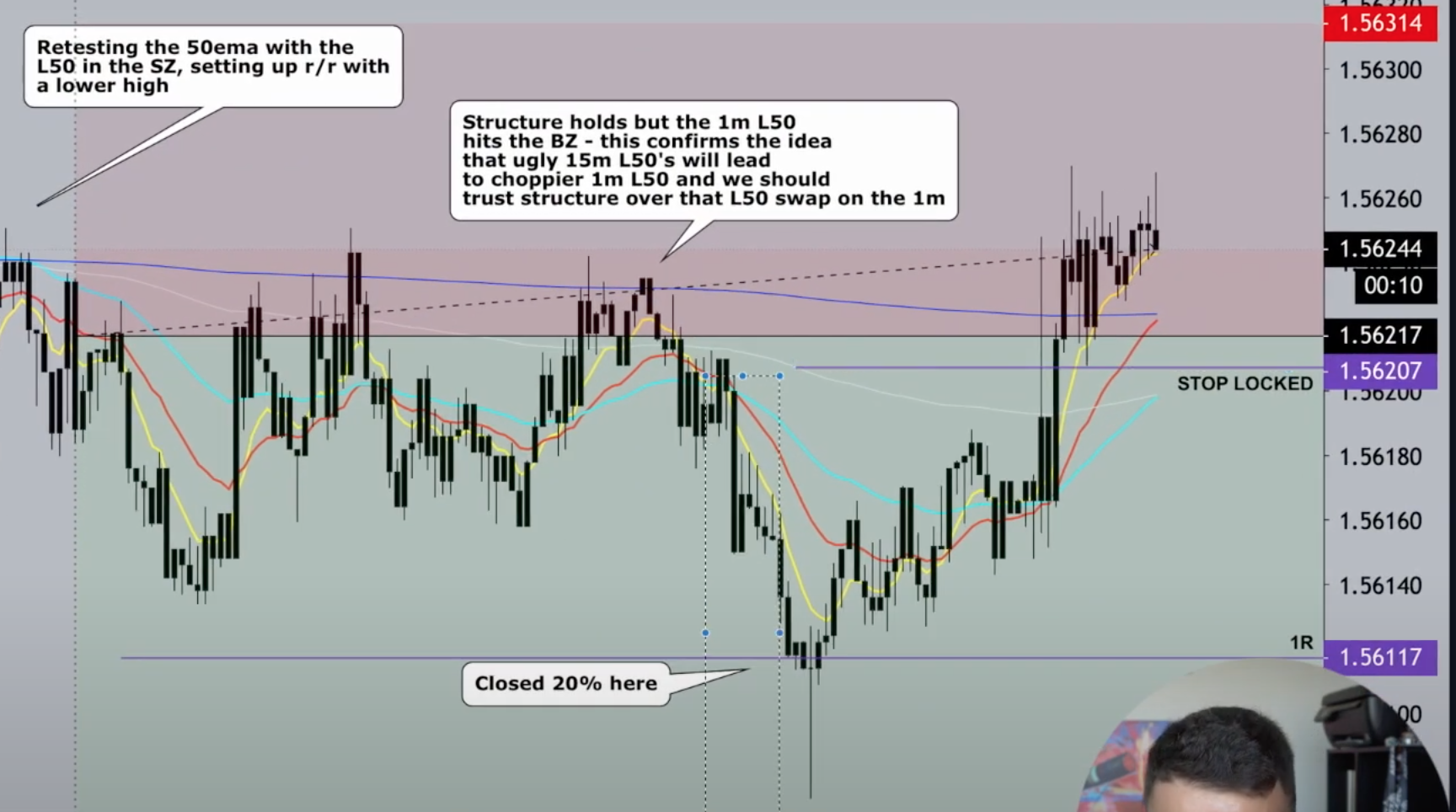

From here you can see where Austin took his position, you can see it only fell about 1R and then it turns around and stops him out in profit. Now, Austin graded this trade a C-set up and he said that in the group chat. As the members followed this in the chat, he wanted them to know that he locked his stop in profit as the trade reached 1R because that’s what his rules tell him to do when trading a C-set up.

How do you qualify this as a C-set up?

You can use the 1 minute and 15-minute chart and ask yourself questions within the ASFX rules. This setup had three major things wrong with it: the liquid 50 (L50) on the 15 min. was rising, the price action was basically trading within the Asian Range, and there was bullish divergence.

So, with those 3 things wrong with it, that instantly makes it a C-set up, so at 1R, Austin locks his stop loss in profit no matter what. This could have absolutely kept falling, but when it breaks the 50 EMA here:

It ends up coming higher all day and into the next day as well. It moved 120 pips in the opposite direction and if Austin had stayed married to the idea that it was going to fall, you’re just getting burned the whole way. Instead, because of our systems, we test rules to go into these systems (this is what is taught in the course). The systems kept him profitable.

“The systems kept me profitable.”

The rules made Austin move his stop loss into profit (you can see it in the chart here):

So when the trade moved to 1R, you can see where he closed a piece of the trade (20%) and moved his stop loss lower. You can see it quickly turned around and stopped him out. Don’t wallow, just move on to the next move.

People always ask, “Austin how do you catch the whole move? How do I call the top? How do I call the bottom?” You don’t. That is not what trading is about. Successful traders follow a process. Following a tested process tells you what to do so you don’t have to react to anything emotionally. You don’t have to feel or think. You just look to what the market is doing and follow your rules without emotions getting in the way.

This is a great example of a trade that stopped Austin out in profit in a good way because it turned 120 pips in the other direction. However, there will be trades where it does stop you and then continues in your trading direction. As a trader, you have to be ok with that and accept that that’s going to happen. Again, you move on to the next trade.

If you watch the YouTube recap of Austin’s EurCad trade mentioned earlier, you’ll see that one is a great example where it breaks out and it never comes back to the entry price and it never retests. In this case, you can move your stop lock as the trade keeps going in my direction.

Enjoy The Ride

Tom Basso, a huge mentor for Austin, says “enjoy the ride.”

“Enjoy the ride”

What he means by this is that he moves his stops up and rides the trend until he gets stopped out and then he waits for the next opportunity.

How are we to say when the market is done moving? We don’t know. No one ever knows. It’s uncertain, so we accept the uncertainty and we let probabilities play out in our favor. That is why Austin is such a big believer in this system.

This forex trade recap is a great example for new or beginner traders because it highlights the importance of having and following a tested set of rules. There are references to previous forex trade recaps in this video, they can be found on our channel. All of these videos work together, trying to give you an inside look at what goes into consistently profitable trading. Your trading may not be exactly where you want it to be, but study Austin’s videos for a few days and that will start to change.

*** Sponsor: Get Surfshark VPN at https://surfshark.deals/ASFX and enter promo code ASFX for 83% discount and 3 extra months for free!

Go to https://asfx.biz/journal to grab your ASFX Trading Journal (FREE SHIPPING for US traders)

Check out https://asfx.biz/ for more info on our courses, real trader testimonials, and more.

Stay Connected With Our Weekly Newsletter — https://asfx.biz/subscribe/

Read About ASFX In The News:

https://finance.yahoo.com/news/austin…

https://www.marketwatch.com/press-rel…

https://finance.yahoo.com/news/top-10…

https://thetradable.com/commodities/g…

https://disruptmagazine.com/interview…

https://londondailypost.com/is-asfx-a…

https://www.thebusinessblurb.com/2020…

https://thehustlersdigest.com/austin-…

More from ASFX…