I’m going to assume you’re here because you’re trying to grow your small account but are continually frustrated, hitting a wall and can’t be consistent.

Let me explain why that is.

We’re going to break down the bad habits that small accounts build and how much money you should really have in your account to get started trading.

I have developed a theory based on personal experience and the plethora of messages I receive on a daily basis.

The Tendencies of a Small Trader Theory

This theory was created because I get a lot of messages that sound a lot like this:

“I would love to enroll in your course but I don’t have the $300. I have a trading account right now with about 100 dollars if you please help me get it to $300 I will definitely withdraw to enroll in your course.”

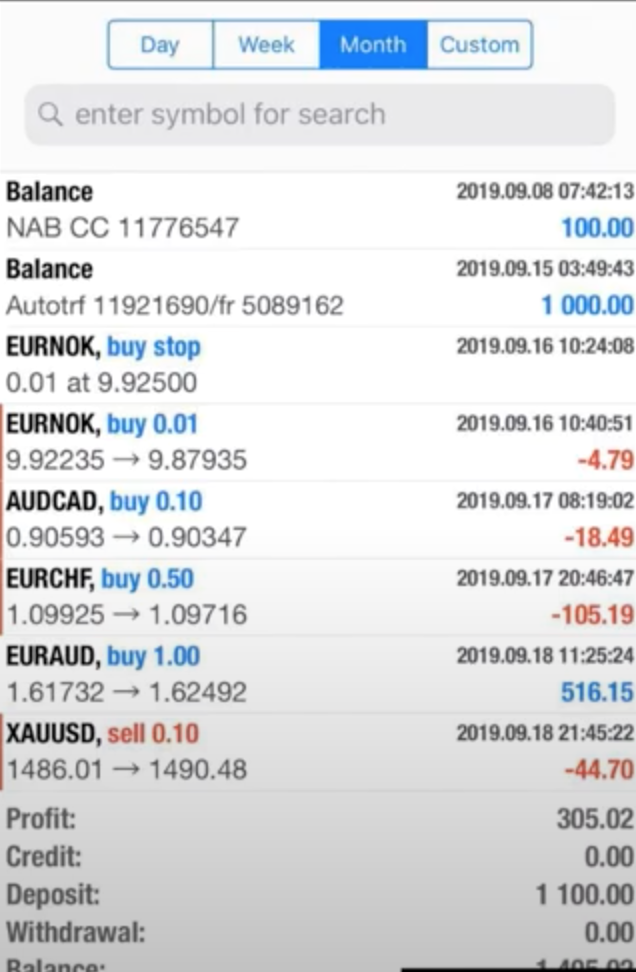

I also see a bunch of P/L like this:

As you can see, this is a $1000 account that took a couple of losses and one big winner with a larger lot size than all the other trades. That one trade ended up making the trader profitable and he was bragging to me saying he was up 30% in his account.

Spoiler: he might have risked half of his account to take that position.

All of these messages and P/L screenshots that I receive have one underlying theme in common: they are almost all small accounts. The fact is that 99% of these traders that start with a small account have developed bad habits very early on in their trading career. I was one of them. I started with small accounts and continued to blow them, so I know these habits are true from personal experience and also from teaching other traders.

Above all, the bad habits are rooted in the fact that they are focused on the money and not the percentages. New traders are very quick to say, “wow I made $300 today” instead of “wow I made 3% today.”

Here are some bad habits that new traders tend to develop:

- They tend to be very focused on the money when they first enter trading, which means they are going to force trades.

- They are going to trade even though they probably shouldn’t.

- They may not even be grading the set-up at all and then that’s just gambling at that point. Gambling in the sense that they’ll be over-trading and chasing trades (getting in late because they see it going up and up, so they try and jump in to catch a few pips.) P.S. don’t do this, if you’ve missed the entry, you’ve missed the entry.

- Strategy bounce, which is an instant shot in the foot as far as trying to build your trading career because you will never see consistency.

- They over leverage on trades (you really do not want to over leverage.)

Now that we’ve identified these bad habits, let’s ask these two questions:

Why can you open an account for as little as $100? & Why do brokers allow traders to use unethically high leverage?

Brokers don’t want you to win.

They don’t care if you win.

The only thing they care about is traders trading and making money.

Beware of gurus pointing people towards certain brokers. These brokers only care about traders churning and burning because they make a small piece of profit on each trade.

Brokers know and understand that 90% of traders will lose their entire account in the first 90 days.

Brokers want to make it easy to fund an account and blow it up. That’s why there is a small initial amount needed to fund and trade an account and the ability to trade with huge leverage.

Again, it’s not that they don’t want traders to win, it’s that they don’t care. They collect the money from the 90% of traders who are blowing their accounts and they don’t care about the 10% that succeed.

How much money do we need to actually start trading? HINT: there’s no perfect answer here.

Having said that, here is my public service announcement: only trade with money that you can afford to lose.

Instead of gambling and throwing around your money, build a risk profile.

Start with defining your risk profile. This means you build a risk percentage that is fitting to you and your trading plan that you can then use to grade your trades. You can then use those risk percentages to determine which setups have the best risk reward.

As you can see, we are talking about percentages and not about money.

For example:

If you want to risk 2% of your account on a trade it will look like this:

$10,000 account 2% risk: $200

$1000 account 2% risk: $20

I know this is basic math, but this point needs to be hammered home.

If you have a $1000 account, 2% risk is about $20.

On some of the pairs in the US, with regulations, you can’t even put 2% or 3% or more on those trades. Knowing this, you want to keep in mind that you can build and grow these accounts IF you are focused on percentages, but that’s really hard for new traders with small accounts because they are almost always focused on the money.

If I could go back in time and compile all the money from my small blown accounts and put it into an account with a regulated broker and slowly grow that account over time, I would have saved myself so much time and so much money.

I also believe that traders get stuck in the mindset that they have to start with small accounts and continuously flip them. That’s not realistic because most people cannot do that. Most people can’t successfully keep the consistency that’s required to continuously grow or flip a small account and that’s why I titled this blog: Why You’ll Never Make Money Trading With a Small Account because most of us won’t.

As I’ve said, the problem is most people (>90%) aren’t able to focus on the percentages consistently. They get caught up in the dollars and breaking discipline which leads to over trading or over leveraging and other bad habits.

In my opinion, you need to start with a sizable chunk of change, but, again, the most important point is that you should be trading only with money that you are ok to lose.

I say this because large amounts of money have their drawbacks too.

Even though a trader has a large account doesn’t mean they are immune to losing money. Also, when you see P/L swings, that money is going to make you emotional. You could react. I know I have. This could mean closing a trade early because the money takes off. For example, you’re up 6, 7, 8 grand and you close it early because you’re trading emotionally when in reality that trade still needs to develop.

So, taking these drawbacks into consideration, please understand that I’m not saying that a large amount of money is THE way.

What I’m saying is this: you need to understand that the amount of money that you start with doesn’t matter.

Any trader that is good and knows what they’re doing should be able to trade any size account because it’s always just about risk/reward. It’s always about keeping your risk as low as possible and not putting too much risk on at once (over leveraging). It’s that simple and it is much easier to do when focusing on percentages and not on dollars.

So, when people come to me and say “Austin, how much money do I get started with? How do I start my trading account? Is it $100, 500, 1000, 5000?”

I always tell everybody, figure out how much you can afford to lose first because I don’t want you to start a small account (100, 500 even 1000) with an unregulated broker and develop bad habits.

I don’t want that to happen to you. I don’t want you to over leverage, over trade, and chase trades. I want you to follow your system and grow slowly over time.

I’ve created this YouTube video on how to view your account as something different than just a trading account and I have also written about it in this blog.

I’m just trying to bring awareness from different perspectives to help you see things differently. These aren’t huge truth bombs or revelations, but I’m hoping that after bringing awareness to this problem you won’t fall into these bad habits. There is no secret number.

Deciding how much money you need to start trading and trading successfully is all about:

1) Figuring out how much money you can afford to lose.

2) Consistently growing, 2%, 3% every trade.

You’ll have to look deep into yourself and decide if you’re ok with slowly growing your account by 2-3% each trade.

Don’t focus on the money, but focus on the % and slowly grow your account, and you can start with any amount in your account.