What Is Forex?

The Foreign Exchange Market, otherwise known as “FX” or “Forex” is the largest and most liquid global financial market. You may have participated in this market without even realizing it.

When you travel to another country and exchange your money with the local currency, the exchange rate allows you to receive the equivalent value of money. For example, if you were traveling from the United States into Europe and you have $100 that needs to be converted into euros, you would find a local exchange booth and sell your dollars while simultaneously buying euros based on the exchange rate.

The exchange rate between two currencies is consistently fluctuating price 24 hours a day, 5 days a week.

The fluctuating price is what allows retail traders (like yourself) to make money in the market. Trading forex is simultaneously buying one currency while selling another currency.

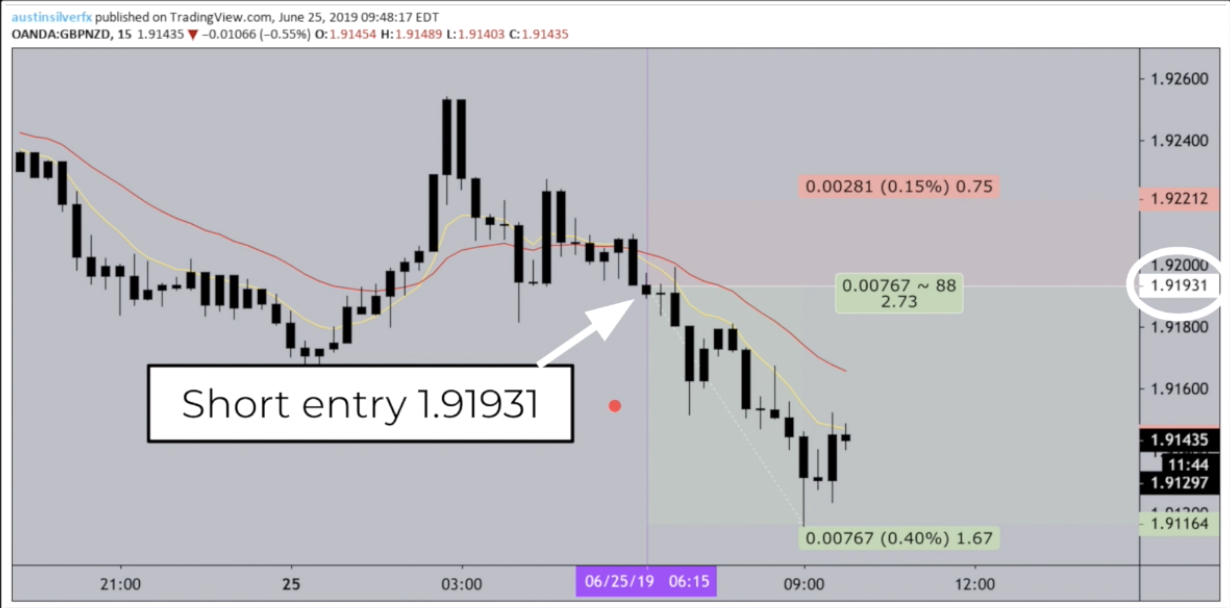

On a chart you are viewing a currency pair. The movement of price is plotted on a chart as candles. Price movement creates patterns that allow us to make probable decisions about the future movement of the currency pair.

Above is an example of what a forex chart setup looks like using the ASFX system.

Forex Market Size & Liquidity

The forex market is considered an over-the-counter market since the entire market is run electronically with neither a physical location nor a central exchange. Since forex is continuously traded 24 hours a day and 5 days per week, you can place trades anywhere as long as you have a stable internet connection.

Since the forex market has such a high volume of buying and selling happening at any given time, the liquidity of the market is very high. High liquidity makes it easier for traders to buy and sell currencies.

What Is Traded In Forex?

Forex is a derivative market, meaning that you do not physically own the currency you’re trading. Think of it like shares of a stock. When you buy a share you don’t physically own the company, but you own a piece, a share, of the company’s speculated value.

Major Currencies

There are 8 major currencies that are traded, which represent a few of the world’s largest economies.

The 8 major currencies include, United States Dollar, Canadian Dollar, Great Britain Pound, Swiss Franc, European Euro, Japanese Yen, Australian Dollar, and New Zealand Dollar.

Buying & Selling Currency Pairs

When you are looking at a forex chart you will notice the chart shows a currency pair. The first of the two currencies in the exchange rate is the base currency, and the second of the two currencies is the quote currency. The base currency is the currency you are buying, while the quote currency is the currency you are selling. The exchange rate informs you how many units of the quote currency you have to buy in order to equal one unit of the base currency.

Long: the act of buying, when you believe a currency’s price will rise

Short: the act of selling, when you believe a currency’s price will fall

How Do We Measure Price Movement?

Price movement is measured in pips, which stands for price in percentage or point in percentage.

Counting pips example…

EurUsd – 1.12345

1.12345 -> 1.12355 = +1 pip

1.12345 -> 1.12445 = +10 pips

1.12345 -> 1.12305 = -4 pips

How Do We Determine Position Size?

When you go to a donut shop, you can order donuts by the dozen. Similarly in forex, you place orders in lots.

1,000 units = 1 micro lot = 0.01 lot size = ~ $0.10

10,000 units = 1 mini lot = 0.1 lot size = ~ $1.00

100,000 units = 1 standard lot = 1.0 lot size = ~ $10.00

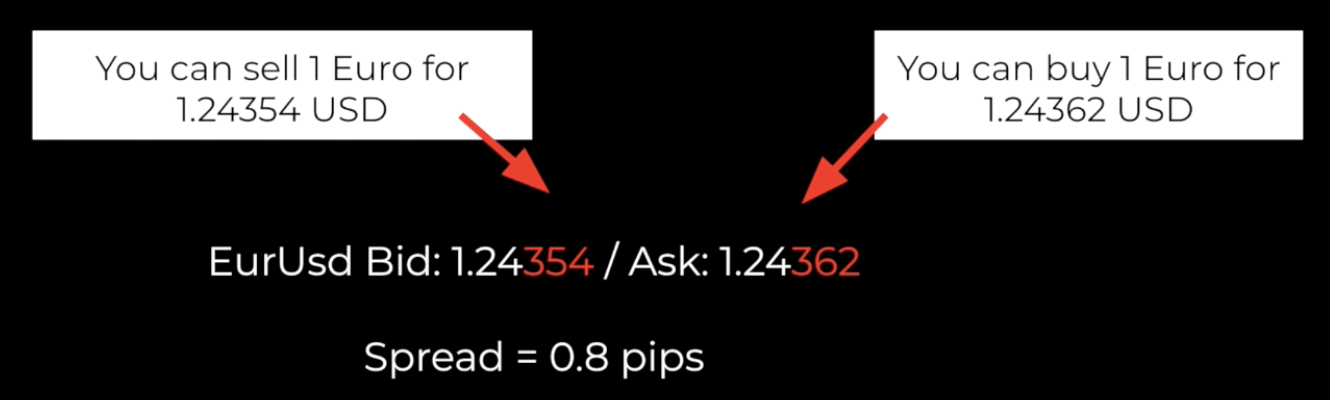

Bid, Ask & Spread

You will see a forex pair quoted with two prices: the bid price and ask price.

The bid price is the price your broker is willing to buy the base currency in exchange for the quote currency. So if you were trying to sell something, the broker uses the bid price to buy it from you.

The ask price is simply the reverse. If you are trying to buy something, the broker uses the ask price, also known as the offer price, to sell it to you.

Spread is the difference between the bid price and the ask price.

The size of the spread tells us 3 things:

- Liquidity – the more available a currency is for buyers or sellers, the smaller the spread

- Size – the bigger the deal, the wider the spread because the broker is taking on more risk

- Time of Day – spreads open up when the market in question is closed

What Are Stop Losses & Take Profits?

A stop loss is a price at which you would be out of your position because it’s moving against you. You can set the stop loss as soon as you enter a trade. In my opinion, you always want to set a stop loss.

When you’re long your stop loss is set below your entry price because if the price drops then you’re losing money since you’re anticipating that price will go higher. If price moves lower to a certain point where that stop loss is, then you would want to be out of the trade to minimize the loss.

Inverse to that, when you’re short your stop loss is set above your entry price. If the price continues to move higher from where you entered the trade, then you’re going to continue to lose money if you don’t have a stop loss.

The take profit level is the price where your position will be closed in profit. When you’re long you want to set take profit levels above your entry price and when you are short you set it below your entry price . In the Beginner Training Course, Austin Silver teaches you a method to know exactly where to put your stop loss and take profit for every trade. To learn more about Austin click here.

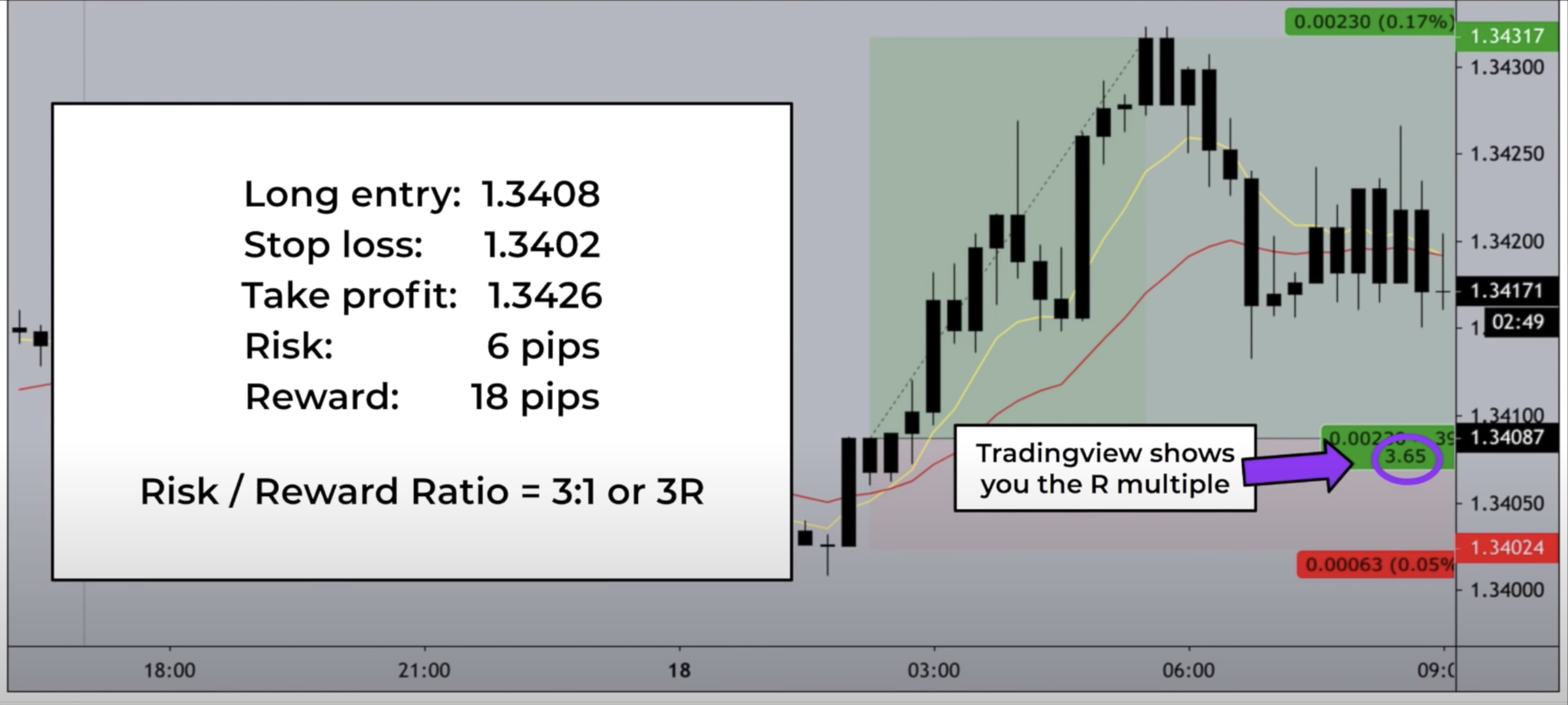

How To Measure Risk/Reward Ratio

Understanding risk/reward is extremely important as a trader. Risk/Reward is also commonly referred to as ‘R multiple’. In order to find your R/R ratio, you divide the potential reward in pips by the risk in pips. Let’s look at an example…

Do You Need A Broker To Trade Forex?

Yes! A broker is set up in partnership, as a cooperation, or as a subsidiary of a bank where you create an account to deposit your funds. The broker executes the trade orders. The brokers make their money by charging a commission per trade and/or a spread.

There are regulated and non-regulated brokers. It is recommended to trade with a regulated broker, but do your own research before depositing funds anywhere. In the United States, the primary regulatory bodies are the Commodities Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Trading With Leverage

Leverage is a powerful attribute of the forex market. However you don’t want to be greedy or aggressive with it. It allows you to use a small amount of money to control a larger amount of money. It’s expressed as a ratio, such as 1:100, which means for every $1 you deposit, your broker gives you $100 of purchasing power.

When trading with leverage you don’t need to pay the full value for your trade up front. Instead, you put down a small deposit, known as margin. When you close a leveraged position, your profit or loss is based on the full size of the trade. Leverage can magnify your profits, but it can also bring on more risk and amplify your losses including losses that exceed your initial deposit, which is why leverage can scare some people. This makes it extremely important to learn how to manage your risk properly in every single trade.

What Is Margin In Forex?

Margin is the term used to describe the initial deposit you put up when opening and maintaining a leveraged position. When you’re trading forex with margin, remember that your margin requirement will change depending on your broker and how large your trade position is. The amount of money you’re putting with the broker is the ‘good-faith’ deposit to open that position.

For example, a trade on EURUSD might only require 2% of the total value of the position for it to be open. This would mean that while you’re still risking $10,000 you only need to deposit $200 to get the full exposure. Initially, you can see the difference from $200 to $10,000, which would be over-leveraging to some people and put you at more risk to blow that entire initial deposit.

When you carry out a forex transaction, you don’t actually buy all the currency and deposit it into your trading account. You speculate on the exchange rate, or in other words, you estimate how the exchange rate will move and you make an agreement with your broker that they will pay you or you will pay them depending on whether the exchange rate moved in your favor or against your initial speculation.

Understanding your broker’s margin requirements is going to help you understand how use your leverage.

Forex Margin VS Stocks Margin

Margin in the forex market is completely different than margin in the stock market. In the stock market, trading on margin is a term that means taking a loan out from your stock broker to purchase stocks. However in forex, margin is the amount of money that you have to deposit to keep the broker happy when you open a position. It’s not a loan, and you never own the underlying currency pair.

The reason why leverage is higher in the forex market is because the market doesn’t move 5, 10, 30, or 50 percent in a day. Some days it moves less than 1 full percent, so in order to make money on those small overall moves, you need to leverage up the size of those positions and that’s why leverage is available in forex.

How To Get Started Trading Forex

Whether you choose ASFX’s education program or another forex education program, the point is that you get educated before you start. Below are some helpful links to get started trading forex.

4 Must Watch Videos Before You Start Forex Trading

ASFX Course Package (Beginner Training Course, Advanced Divergence Course & VIP Chat)

Charting Software: TradingView

More from ASFX…